Reflexivity is a theory from sociology and epistemology that has embedded itself within finance. You likely won’t learn about it in economics or finance classes because it goes against most of what we are taught, and it requires a capacity to reflect that is a pay grade above DCF analysis. The initial building block to understand reflexivity is a feedback loop.

A feedback loop is an occurrence wherein the output of a system amplifies the system (positive feedback) or inhibits the system (negative feedback).

In finance, reflexivity refers to the positive feedback loops of market sentiment, through which rising prices attract buyers, driving prices even higher, until the process becomes unsustainable or economic fundamentals materialize. Definitions in context of finance tend to be quite dry.

A philosopher may remark the following about reflexivity: Our collective perceptions can affect fundamental reality and outcomes of events. Definitions in context of philosophy tend to be quite clear.

The basis of reflexivity revolves around our conception of reality. There are two realities:

Objective reality

Subjective reality

Objective reality is true regardless of what a participant thinks about it. For example, if you say it’s raining outside, and it is in fact raining outside, then we have established objective truth. It is raining regardless of whether I or anyone else thinks otherwise.

Subjective reality is affected by what participants think about it, hence why markets fall into this category. Prices are set in markets by a group of participants making judgments about what assets should be valued at. This tug of war moves markets and produces winners and losers. Therefore, what we think about reality ends up affecting reality itself.

Reflexivity matters because a question arises as to whether we can potentially will certain circumstances into existence through collective participation.

Reflexivity In Context of Investing

One of the biggest advantages that Tesla ($TSLA) has had over its competitors is low cost of capital, arguably access to unlimited free capital. There are three ways to raise capital - debt, issuing equity, or using net earnings from operations. When I say “unlimited free capital”, I am mainly referring to Tesla’s comfortable ability to issue shares (of course, it's a slight hyperbole).

Tesla is the ultimate narrative stock. It’s possible because Elon Musk inspires enough confidence that the collective ends up creating a positive feedback loop, which eventually helps economic fundamentals materialize1. The Biden Administration is attempting to counter Tesla’s access to capital by subsidizing Ford and GM EVs, but both companies have yet to really show up on the competitive map.

An aside: Here’s a link to Mary Barra, current CEO of GM, claiming that GM is the EV leader in America, after acknowledging that their market share is 9% vs. Tesla’s 63%. She’s nuts.

We have also seen reflexivity in action in everyone’s favorite two meme stonks - GameStop ($GME) and AMC ($AMC). If there was a master of reflexivity, it would be the subreddit WallStreetBets. GameStop’s management team rightfully issued $551M in shares as the stock rallied, which they then used to fund their e-commerce strategy. AMC’s management team raised over $1.2B through share sales, and they even doubled down on their retail base by announcing that shareholders would receive a free large popcorn when they attended their first movie at an AMC theater in the summer. The thesis or hope for hodlers can be one of two options: (1) Economic fundamentals will materialize, or (2) they’ll be able to sell the shares to a buyer at a higher price (Greater Fool Theory).

Reflexivity In Context of Beauty & Art

Beauty is another example of subjective reality. Beauty is somewhat in the eye of the beholder. However, it is undeniable that collective perception creates a tug of war that impacts reality in context of beauty. As broken as they are, where do you think beauty standards come from? Reflexive feedback loops are deeper than financial markets, embedding themselves in our cultures. Pete Davidson and his dating life seem to simultaneously confuse and entice people. Perhaps attraction is likely subject to reflexivity as well.

Art is one of the easiest domains to see both mass hysteria and reflexivity. The Mona Lisa in my uneducated opinion is underwhelming. It is a 77cm x 53cm (30in x 21in) portrait of a woman we know very little about, and it isn’t even remotely close to being one of Leonardo Da Vinci’s best works. Where does it get its value? If you have even a remote interest in NFTs, the answer you’ll know very simply is provenance. While there are several different definitions, “provenance refers to the history of ownership of a painting or other work of art.” Provenance and reflexivity are best friends. Once you give anything or anyone a good enough story, you can unleash reflexive loops that will pervade through history.

Here’s a quick anecdote to really strike home how powerful and strange reflexivity in context of art can be. In early 2019, during my exchange program in France, I was visiting the Louvre with some new friends. It wasn’t my first rodeo seeing the Mona Lisa, so I knew we were going to walk into that classic room and barely be able to see it due to the crowd. I learned a lesson on human psychology that day.

This is a picture of one of my best friends, Patrick-Laurent Messara, with an umbrella in hand, standing in front of the painting right across from the Mona Lisa. If it doesn’t strike you as odd immediately, think about what’s off for a few seconds.

There are two glaring things that are almost immediately noticeable to me:

I haven’t managed to even get the entire painting in frame.

There is somehow no one else in the painting despite us being barely 5-10 meters away from the Mona Lisa.

(1) It turns out that I was unable to get the entire painting in frame because I was back to back with people who were looking the other way at the Mona Lisa2. (2) No one really cared to take any pictures with this beautiful painting because they were too busy drooling at the Mona Lisa. This painting is called The Wedding at Cana. It is a late Renaissance painting that depicts the miracle, in which Jesus turns water to wine. The painting is fucking huge 6.77m x 9.94m (22’3’’ x 32’0’’), and I think it’s a lot more impressive than the Mona Lisa. Here’s the twist or perhaps the denouement of this story. A number of people in the room noticed what we were doing, and suddenly other groups of people started taking pictures in front of The Wedding at Cana. I presume there was a moment of realization that one of the most impressive and technical paintings in the Louvre sat across from the most well known painting in the world. Collective perception, provenance, and reflexivity can blind us in moments like these.

Maybe it’s just me, but I find reflexivity somewhat unsettling. It makes me question how much of what I experience as reality or the truth is really just collective perception. How much of what I believe to be true is fabricated? This is the loop that eventually brings you to the timeless debate around free will. What is propaganda if not a state or a system that has decided to unleash a reflexive loop on unsuspecting people. Not everyone minds being subject to propaganda as long as it fits within their acceptable set of beliefs. As much as it is a newspaper’s job to deliver the facts, it’s also to be a conduit for propaganda - the dissipater of objective and subjective truths.

To be clear, reflexivity and propaganda can be used for relatively positive causes as well. Think about how the war against smoking has been waged in the US. There’s been a combination of taxes, regulations, and extremely aggressive messaging (propaganda). The goal has always been to make smoking appear very uncool because if you can make it uncool, you achieve a reflexive loop among young people through the opposite social pressure that initially gets people into smoking. Vaping has been a pain in the ass for what was a very successful campaign, but that’s slowly being handled too.

From an investor’s perspective, it’s important to keep in mind that we don’t base our decisions on reality. We base our decisions on our perception of reality. This has allowed the birth of several of the great tech companies today. Ultimately, profitability and free cash flow do matter. However, there are cases where reflexivity can be leveraged to delay when those factors need to materialize. Tesla was allowed to burn cash for years with widening losses as they scaled through production hell for the Model 3 because enough investors believed that consistent revenue growth would eventually materialize into profits and free cash flow. Tech companies like Amazon and Netflix benefitted from similar patterns. Amazon and Netflix were both mocked for not being profitable, but the stocks ripped on the belief that the companies would either eventually be profitable or there would be a higher bidder on the shares (Greater Fool Theory). These high flying stock prices once again led to factors that would eventually allow success to materialize:

Cheaper financing costs/low cost of capital.

Attracting exceptional talent - intangible assets like talent cannot be captured through archaic GAAP accounting, and they’re a better indicator of returns than most metrics. This could be a whole essay in itself.

Pricing out competition, therefore winning market share because you don’t have to worry about getting your stock price killed after an unprofitable quarter.

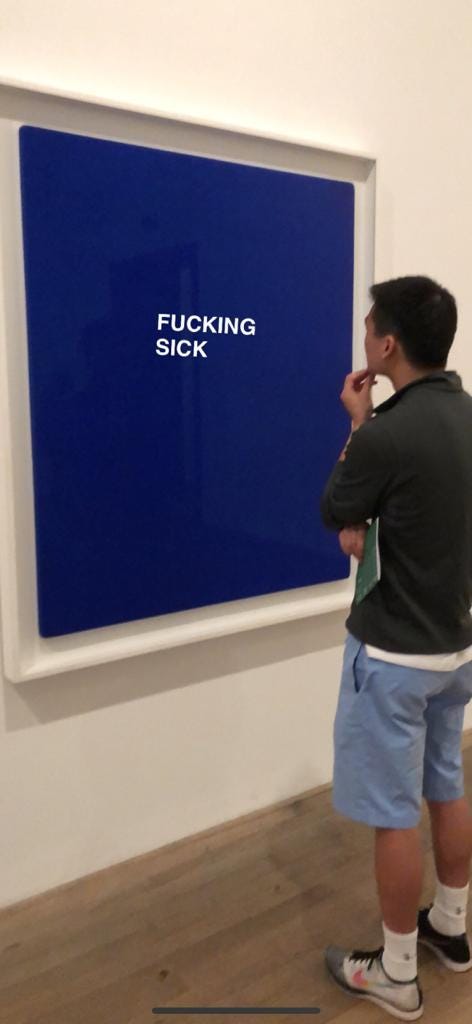

Once you start looking for it, reflexivity is everywhere. If I were to be self critical, I would point out that I also could be conflating reflexivity with a whole host of other psychological biases. My self rebuttal would be that perhaps that’s true, but I think there’s an undeniable link between those biases and reflexivity. What is most important is that you recognize when a dangerous reflexive loop is occurring in front of you. Over time, you’ll master the identification process, and eventually it can actually become a source of humor or fun. Contemporary art museums make me question my sanity, but I always leave creasing at the tour guide who is explaining the significance of a plain blue canvas with nothing on it.

This is a picture of another one of my best friends, Chris Chai, intently observing a gorgeous painting in the Tate Modern. We’re not sure what the name is, but it’s pretty fucking sick.

Disclaimer: This newsletter is not investment advice. This newsletter is an outlet to discuss topics that I find interesting often related to philosophy, investing, psychology, tech, and the future. Please do your own research before purchasing any securities.

To be clear, Tesla could not have succeeded without ruthless execution, an iconic product, and an all-star team. Reflexivity is not a sufficient condition for success.

I also was using an iPhone X, which I still use today. I’m upgrading to the newest gen any day now.